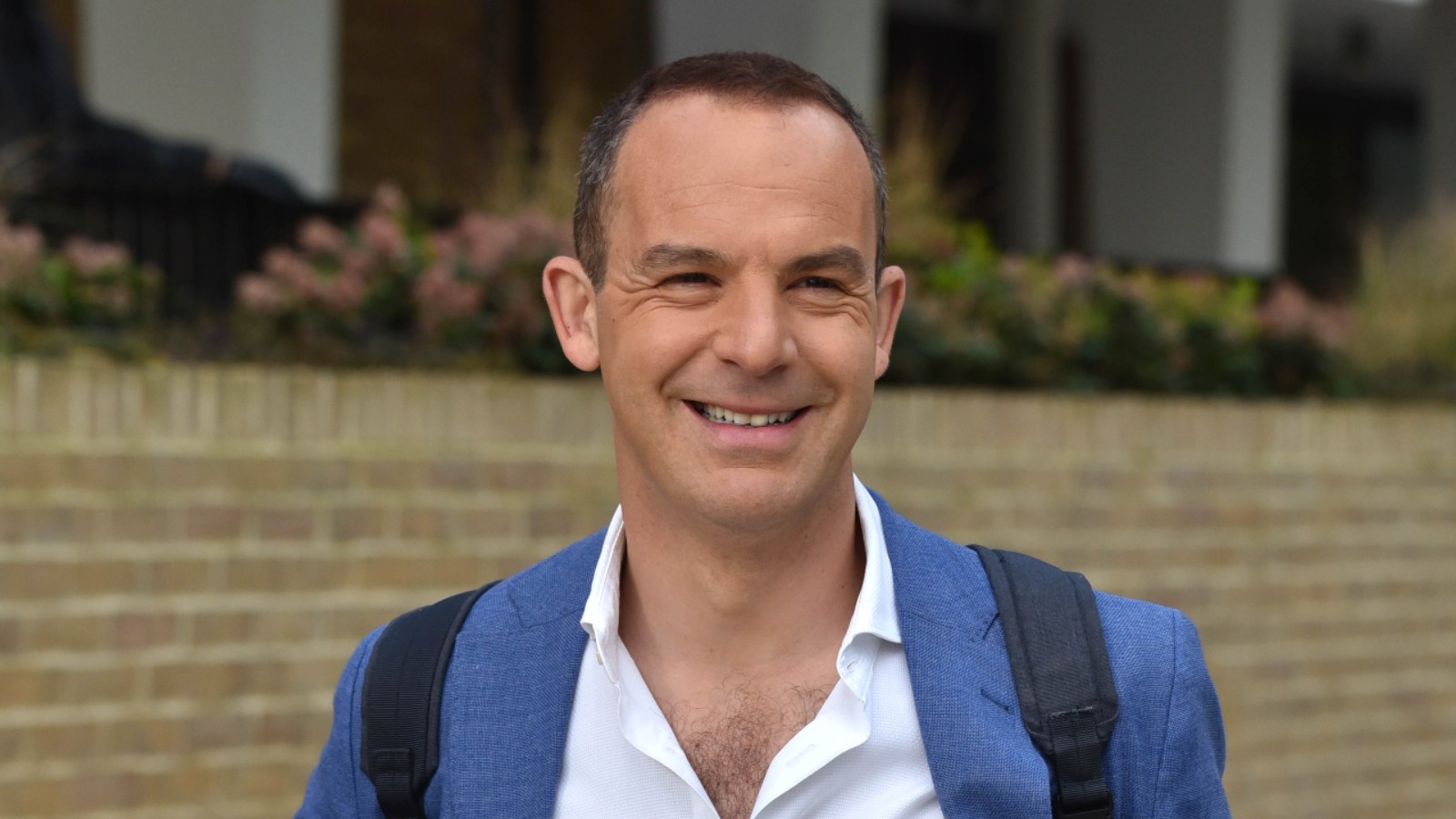

Martin Lewis issues a warning to employees planning to drop out of their workplace pension scheme

Financial expert Martin Lewis, has urged Brits to double-check their workplace pensions which can double or triple their money.

It can be difficult to navigate the world of pensions, but it is necessary for anyone who wants to make the most of their retirement years, since a good pension pool can make a significant difference in later life living standards.

While watching that extra money leave from your pay packet every month can be difficult pill to swallow as the cost of living rises, Martin Lewis argues it will pay off in retirement and is effectively a pension "pay rise."

During Martin Lewis' pension warning he explained how private workplace pension schemes work and recommended Brits to check and change their work policy right now for better advantages.

Martin explained that for every penny you put into the pension, you pay less tax on it, and your company will match it.

According to the money expert, auto-enrolment into a workplace pension means that "most employees now save by default," which means that if you're between the ages of 22 and State Pension age and earn more than £10,000 per year, you'll be automatically enrolled in a pension scheme.

As energy bills rise, the average household will be keeping a close eye on their income in the hopes of saving money. From April, household budgets will be put under considerably more pressure amid the wait for the real Living Wage to go up.

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

Martin Lewis' pension warning comes after he recently shared a simple tip for low-wage employees to earn a "hidden" pay raise, which is great if you're looking to save money this year.

The minimum contribution into the pot is 8%, with employers contributing at least 3% to staff's monthly wage. To meet the minimum, employees need to contribute 5% of their earnings.

Martin explained how a worker who contributes £80 to an auto-enrolled pension will receive £160 when it's time to retire. For a higher tax payer (those paying 40%), the amount paid in could be smaller, generating in a bigger return when they receive their workplace pension.

However, if you already have a sizeable pension plan, opting out might send you over the £1,073,100 lifetime cap. If your current pension is complicated, he recommends speaking with a financial advisor.

"For every £100 you put in, on the minimums, your employer would have to add £60 towards your pension pot.

“But basic rate taxpayers don’t lose £100, you only take home about £80 - £20 would be taxed - so in effect, you lose £80 in your pay packet, but you get double that - £160 going into your pension,” Martin explained.

Martin has previously given his guide to topping up the pension pot.

https://www.youtube.com/watch?v=gY0swd74o00

For those seriously considering opting out of a pension Martin continued, "There's nowt out there like it, which is why my big message here is that if you opt out, you are effectively giving up a pay rise and you're giving up the tax benefit too.

"Of course, you are going to take home less, but what you get in the pension return is so important, so don't opt out unless you absolutely have to."

Kudzai Chibaduki joined Future as a trainee news writer for Good To, writing about fashion, entertainment, and beauty. She's now a freelance fashion wardrobe stylist and helps direct magazine photoshoots.