When will energy prices go down for your family?

Millions of families have been wondering when energy prices will go down now that the price cap is confirmed to drop

Sarah Handley

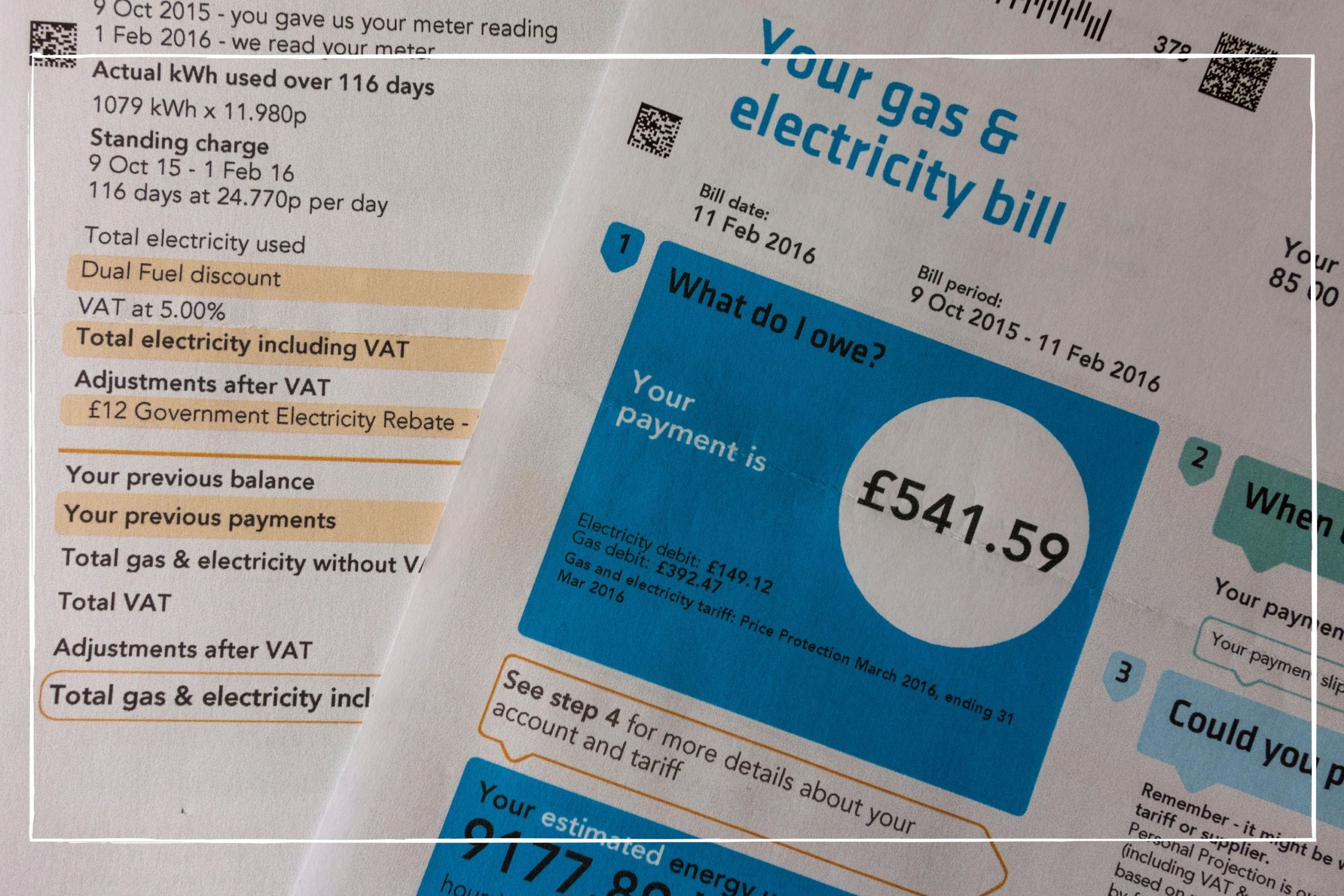

Millions of people will be wondering when energy prices will go down after a long cold winter for those struggling with sky-high energy bills.

It was only back in 2021 that households typically paid about £1,200 a year for their energy. Now, we're pay more than twice that figure, putting pressure on ever-stretched family budgets. The price increases have left many billpayers worried about how much our energy bills will cost.

There are multiple reasons why energy prices went up sharply – including increased demand when the world came out of lockdown after the Covid pandemic, and then the war in Ukraine which began in February 2022.

The government’s Energy Price Guarantee has offered some protection from high energy costs – but we’re still paying more for gas and electricity than ever before. But as the price guarantee is due to end at the end of June, and the energy price cap in place from July onwards, we look at what that means for energy bills. If you're completely flummoxed, check out our guide where we look at common price cap confusions and explain what you need to know.

Goodto.com's Money Editor Sarah Handley says: "After months and months of paying more than ever before for the energy we use, lower prices are finally in sight. But even though prices are dropping, they unfortunately aren't dropping to pre-energy crisis levels."

Will energy prices go down in 2023?

Energy prices are set to drop from July onwards, when the energy price cap drops below the level of the price guarantee. Unfortunately, it’s unlikely that we will see gas and electricity bills return to the levels they were before Covid anytime soon, if at all. The July price cap has been confirmed at £2,074, significantly more than the £1,200 level of the price cap back in 2021.

Russia’s invasion of Ukraine has led to the UK (and other countries) being keen to decrease reliance on gas supplies from Russia and invest in renewable energy sources instead. Investment in new energy sources will need to be paid for – so our bills will remain relatively high.

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

Another key reason as to why we’re still paying high energy costs is that energy suppliers buy gas in bulk many months in advance, so they know they've got sufficient stock. Currently we’re still using gas bought at high prices last year.

But wholesale gas prices have fallen since the start of 2023, and these savings (roughly £426 a year, compared to what families are paying under the price guarantee) will filter through to families from July 2023. There are multiple reasons that have led to this drop in wholesale prices:

- Mild weather for this time of year in the UK and Europe

- Gas storage levels higher than expected

- Efforts by households and businesses to use less energy

- Low demand in East Asia due to high prices

- Reduced dependence on Russian gas in Europe.

At the beginning of December 2022 wholesale gas cost about £3.40 per therm (a therm is a unit of heat) – more than eight times the price it was in December 2020. But now the price is about £1.12 a therm – so about a third of the price it was in December 2022.

When will my energy bills start to go down?

Lower wholesale gas prices are expected to feed through to lower household energy bills from July 2023. The Ofgem energy price cap will go down to £2,074 a year for a typical household from the summer.

In terms of when we might see a huge drop in energy prices, that's less clear. What happens in Ukraine – and the world’s reaction to it – is a big factor that makes it hard to predict when our energy bills will fall significantly. The weather is a key issue too. Large parts of the UK experienced a cold snap at the beginning of March, boosting demand for heating. This could lead to supply issues, but the US has agreed to increase natural gas exports to the UK as part of a joint effort to reduce costs and limit Russia's impact on western energy supplies.

For more information on how much your energy bills could change from July, use our handy calculator.

When should I look for a new energy deal?

There’s not much point in looking for a new energy deal at the moment. Experts say people are generally better off staying on their current supplier’s standard tariff rather than switching to a fixed-rate tariff, especially as variable rate tariffs are protected by the government’s price guarantee.

Energy suppliers have mostly paused offering fixed-rate energy tariffs – while those that are available are expensive. Now that a lower cap has been announced, we might see more fixed-price tariffs return, but when that happens it will be crucial to do your sums to make sure you will actually save over the course of the fixed deal compared to staying on a variable tariff and having your bills calculated using the price cap. Use a price comparison website like Go.Compare to check whether you can save money by switching.

Until there are good deals available, a key factor to keep bills as low as possible is to know how to save energy in your home. If you are struggling to pay your energy bills, you're not alone and assistance is available. Speak to your supplier in the first instance.

When prices eventually come down, should I move to a fixed-rate or variable tariff?

Whether you choose a fixed-rate or variable tariff will depend on your circumstances and what’s happening in the energy market.

When prices come down, you should compare both types of deal to find the best option. Using a price comparison site, such as our sister brand Go.Compare or ComparetheMarket, will help you find the best deal available when prices come back down.

You might also wonder whether you can benefit from cheaper electricity with a time of use tariff, but make sure you read our guide to whether electricity is actually cheaper at night before you commit.

Video of the Week:

Emma Lunn is a multi-award-winning journalist who specialises in personal finance and consumer issues. With more than 18 years of experience in personal finance, Emma has covered topics including all aspects of energy - from the energy price cap to prepayment meter tricks, as well as mortgages, banking, debt, budgeting, broadband, pensions and investments. Emma’s one of the most prolific freelance personal finance journalists with a back catalogue of work in newspapers such as The Guardian, The Independent, The Daily Telegraph, the Mail on Sunday and the Mirror.

- Sarah HandleyMoney Editor, GoodtoKnow