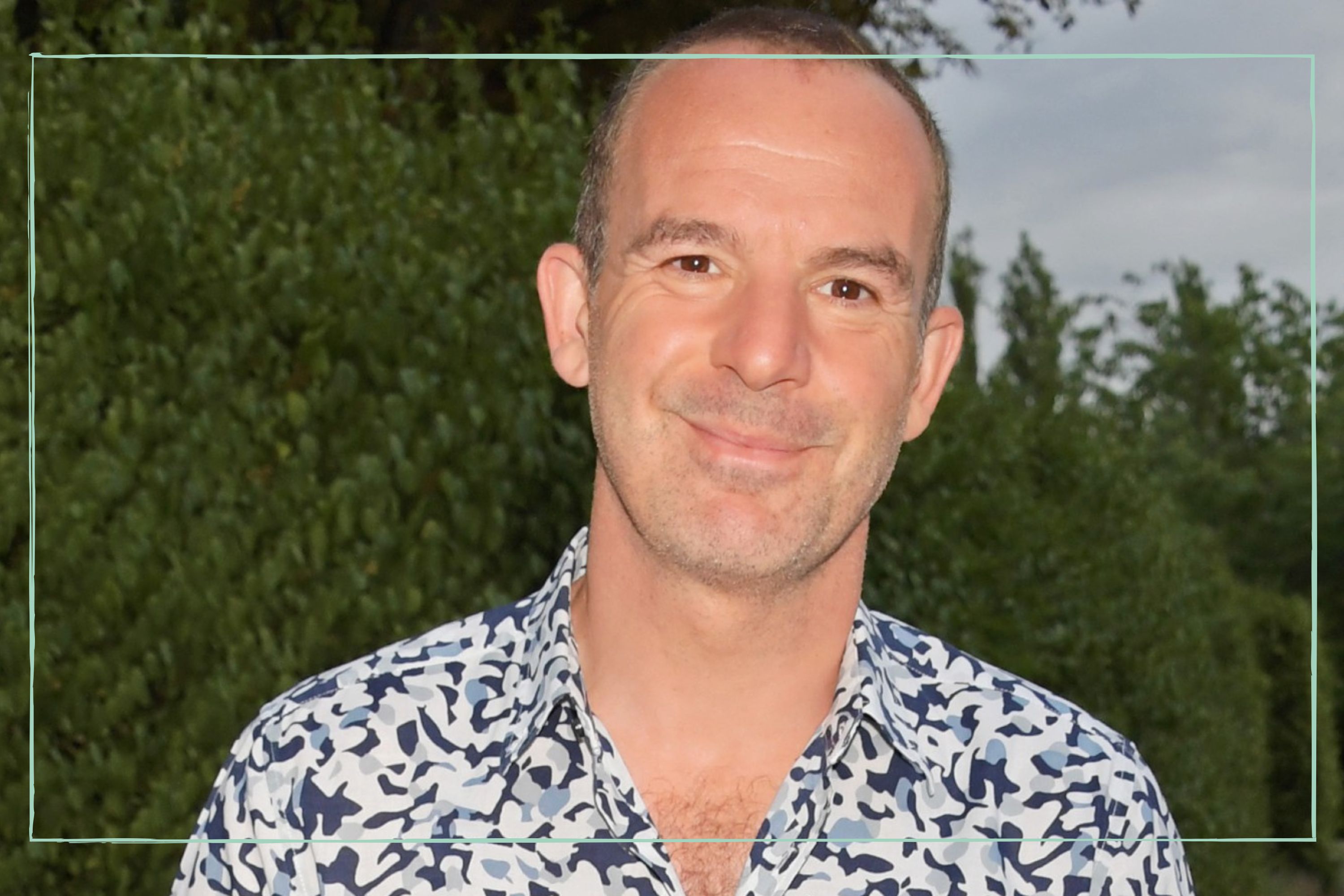

Martin Lewis urges holidaymakers to avoid this mistake when paying for goods abroad

The money saving expert warns families not to get caught out when travelling abroad for your holiday

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Martin Lewis has highlighted the one button holidaymakers should never press when using a card or cash machine when abroad.

Speaking on The Martin Lewis Money Show, the money saving expert explained how pressing the 'convert to GBP [pounds]' button on an ATM or when paying by credit or debit card could be costing families significantly more than if they paid in the local currency. With inflation still high, it's never been more important that families understand how to save money on holiday, both before they go and when they are away.

This warning comes soon after Martin issued a desperate plea for families to get travel insurance as soon as they've booked their holiday to protect their investment and ensure peace of mind should you, or someone in your family become ill or have an accident on holiday. The money saving expert has also warned families around data charges while abroad. If you're planning on staying in a hotel on holiday, make sure you try this hotel hack to see if you can save money on your booking.

Never 'convert to GBP' if using a card abroad

Especially in a post-pandemic world, we've all become used to using plastic to pay for most things rather than cash. When you're at home, it's not usually problematic as you are paying for goods and services in your local currency. But when you go abroad, you might feel that you need to convert the payment into pounds when paying my card or using a cash machine.

But these machines charge a conversion fee, which is added on top of the exchange rate, meaning you're paying even more.

Martin Lewis said: "You want your card company at home to do the conversion because, even if it's not a good card, it's a better rate. Continue with conversion? No way, it's going to cost me 20 quid more than it should.

"When you go into a shop, when you go to a cash machine, and it says "do you want us to do the conversion for you", no, no, no. Pay in the local currency."

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

Martin added that holidaymakers could consider one of the best travel credit cards (our sister site The Money Edit has rounded up their top picks) to avoid any unnecessary charges. This can be preferable to travelling with cash, which might be lost or stolen, and you might be unable to claim the amount you lost back on your travel insurance policy. Always use an eligibility checker before applying for any kind of credit card or loan to see your chances of being accepted. This will prevent your credit score from being negatively impacted.

Looking for more Martin Lewis money tips? Check out Martin's council tax tip that could save you hundreds of pounds each year, Martin's energy tariff warning, the trick he uses to save money on medication, and the passport mistake all holidaymakers should avoid this summer.

Sarah is GoodtoKnow’s Money Editor. After Sarah graduated from University of Wales, Aberystwyth, with a degree in English and Creative Writing, she entered the world of publishing in 2007, working as a writer and digital editor on a range of titles including Real Homes, Homebuilding & Renovating, The Money Edit and more. When not writing or editing, Sarah can be found hanging out with her rockstar dog, getting opinionated about a movie or learning British Sign Language.